Published on September 28, 2016 on LinkedIn by Brett Potts

—

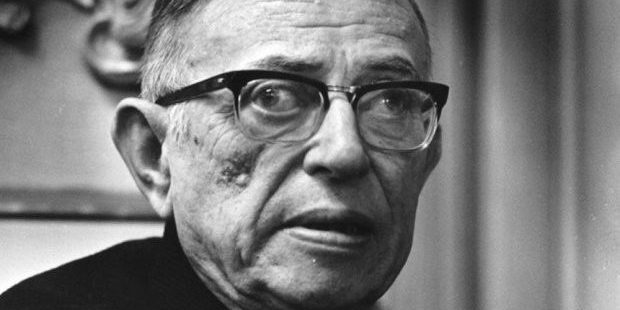

Many years ago, in 11th Grade AP French, our teacher Madame Bertrand directed us to read Jean-Paul Sartre’s classic play, Huis Clos (in French, mais oui!). Requiring a great deal of caffeine and extensive margin notes, this was an excruciatingly painful effort, for two reasons.

First, often translated to “No Exit” in English, the play lays out Sartre’s vision of Hell… an unhappy place where no exit strategy applies. Apparently, Hell is no fun, even if you’re an existentialist.

Second, the process itself was gnarly. Reading a play in English is tricky enough. But, attempting to translate fifty year old foreign dialogue into a meaningful story in my head literally made my ears sweat.

Which is precisely the feeling a lot of our clients start with when they think about selling their business or raising a meaningful amount of capital.

This is why my friend and business partner, Val Giannini, wrote his 12 Steps to prepare for a successful financing or sale. Let’s pare these down a bit for the small business owner with $3 million – $50 million in revenue and a certain level of insouciance (mandatory French word).

Disclosure…. These steps don’t cover how to convert a business model in preparation for an exit (an approach clearly explained in Built to Sell by John Warrillow, which is a fun and interesting read). Rather, the Six Steps below are for those of you who are advising or otherwise involved with a revenue-generating, for profit business, offering a compelling product or repeating service, which is beginning to consider a new future and needs preparation.

Step 1 — Fill Gaps in Management and Board Seats

36-48 months in advance of your intended capital raise or sale, review your roster for completeness. Most of the recent acquisitions we’ve been involved with keep nearly the entire management team in place, especially if the team and individuals have a track record of success (meeting or exceeding revenue and earnings projections). This is smart dealmaking on the part of the acquirer, especially given today’s war for qualified talent. So, offer a strong team. If a capital raise is the goal, think carefully about the capabilities of your existing team to execute — how professional, experienced and competent are they? Board seats are a different matter — most boards do not survive an acquisition — but strong outside directors are often the very best advisors you can find and there is a lot of room to align your incentives with those of your directors.

Step 2 — Hire a CPA and Listen

Specifically, 24-36 months in advance of your intended raise or sale, have a CPA help clean up your Balance Sheet. This might include removing real estate you don’t intend to sell or paying off loans to owners by converting to bank debt. Ask your CPA to recommend changes to procedures that may be frowned upon by public companies or are non-GAAP compliant. Look closely at inventory and payables. Consider whether to invest in audited financials.

Step 3 — Plan with Advisors

A minimum of 12-18 months in advance of your raise or sale, spend 3 or 4 days interviewing those who might be able to assist you. For example, a good investment banker will provide you a set of “precedent transactions” to give you a feeling for deals recently completed in your space. A strong banker can offer you very detailed guidance on issues such as anticipated valuation. Find out whether your existing attorney has deal experience, how recently and whether the deal closed. Find out whether he or she has tax and real estate planning experience, or ask for a referral to an advisor who does. It’s been our experience that effective tax structuring can make a 20-40% difference (or more) in the cash value of your exit.

Step 4 — Exceed your Projections

At a minimum of 12 months in advance (preferably make this an annual practice many years ahead), create detailed projections with your CPA, CFO or VP Finance and be sure these are just conservative enough that you are highly likely to exceed the annual revenue and earnings goals. Look for expenses that an acquirer will not have to make and consider discontinuing them.

Step 5 — Position the Company and Raise its Profile

Seek positive PR opportunities, such as an article in a business journal, a video piece on a news channel or a public interview of some sort. Join panels at trade shows. Invest in marketing and PR. Study the competition and be able to succinctly describe how you compare from the customer’s viewpoint. This last point may go without saying, but honest, direct conversations with long term customers can become an invaluable asset as you consider how to position your company’s value to an acquirer.

Step 6 — Prepare for a Long Process and Due Diligence

It’s an extremely rare sale or capital raise that is completed early and with less distraction to the company than anticipated. Often, the process takes twice as long as expected and some surprises turn up in diligence. To minimize this, hire your bankers 10-12 months ahead of your transaction deadline and be direct with them. Any surprises can hurt enterprise valuation, so work with your team to uncover potential red flags early and have a response in mind.

At NewCap Partners, we are here to assist you as you navigate these steps. While we hope it is less painful than translating Sartre, it will not be an easy undertaking. Selecting an investment bank you trust and a competent banker you enjoy working with should simplify things.

In the meantime, you may be inspired by another French artist, Inspector Clouseau, who famously said, “For me, the greater the odds, the greater the chaulleunge!”

The inspector didn’t make a lot of sense, but if you haven’t seen Closet Ploy recently, it may just brighten your day.

—

Brett Potts

(310) 920-2153